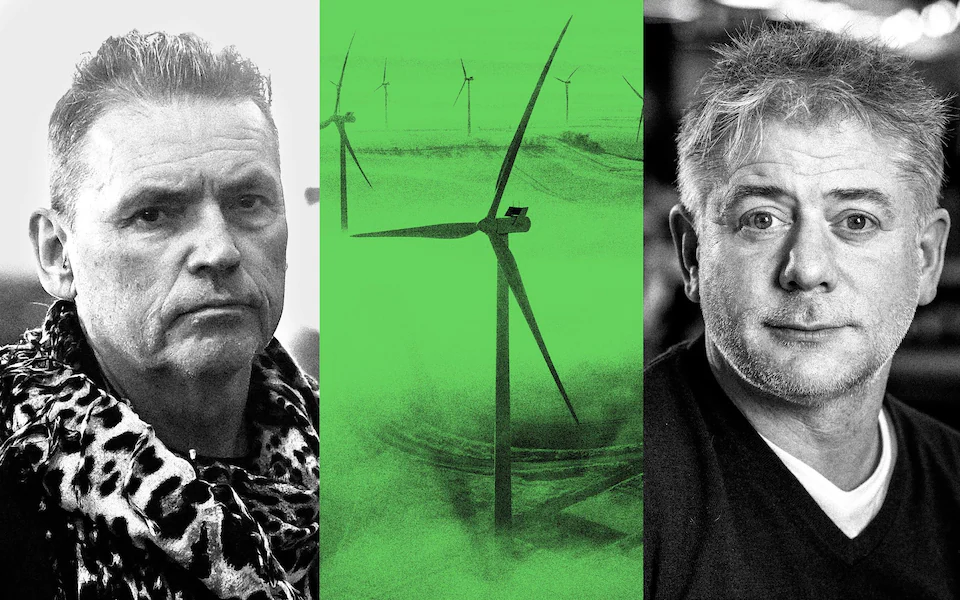

Britain’s green energy tycoons are at war, Greg Jackson, the chief executive of Octopus Energy, is taking on Dale Vince, Ecotricity founder, in a fight over the best way to achieve net zero.

At the heart of the battle is a radical new scheme being considered by Ed Miliband, the Energy Secretary, called zonal pricing, under which Britain would be divided into zones with different power prices.

In a round of briefings last week, Jackson set out why Octopus, the UK’s biggest energy supplier, is backing the idea – prompting a swift backlash from Vince, who ridiculed the scheme as unworkable and questioned his rival’s motives.

Jackson’s key criticism of the UK’s current “crazy” power system is the way it has encouraged developers to build vast wind farms in Scotland, despite there not being power cables to transfer the electricity generated to customers.

This leads to thousands of turbines being unnecessarily turned off, he says, costing billpayers millions of pounds in the process.

“If you look at what’s causing our record high energy costs at the moment, we banged a load of renewables on to a system that wasn’t designed for it,” says Jackson. “As a result, the biggest wind farms in the UK, that should be the most productive, stand idle the vast majority of the time.”

Jackson calculates that zonal pricing would save households at least £3.7bn a year, equating to around £132 per customer. That figure will certainly appeal to Miliband, who this summer will decide if zonal pricing is introduced.

Just hours after Jackson’s briefing last week, Vince released a carefully crafted report warning that zonal pricing would be massively complex, delay the UK’s net zero programme and burden poorer households with extra charges.

And that was before he launched a personal attack on Jackson.

“I don’t understand why Greg Jackson is evangelical about it,” says Vince. “But part of me thinks that he’s looking for a cause to campaign for and make a name for himself because there are so many better things we can do to bring energy prices down.”

Lower costs, or more uncertainty?

The spat marks a new phase in the war over zonal pricing, one that has been simmering for at least a decade but was previously confined to academics, energy analysts and suppliers.

It first came to the fore last year when Miliband ordered a review of electricity markets. But the debate has been revived of late after zonal pricing became a real possibility.

But what is zonal pricing? And why do Vince and Jackson care so much?

At the moment, electricity costs are the same across the UK. However, under the proposed new regime, the country would be split into 12 zones – with power prices determined by geographical supply and demand.

Prices would fall for consumers close to energy hubs such as wind farms, but would rise if electricity had to be imported from other zones.

The practical result, say most experts, would be to cut power prices in the North – where there are lots of wind farms – and sharply increase them in the South.

Jackson loves the idea because he believes it would stop renewables developers from putting wind farms in places starved of infrastructure and households.

“It would be mad to keep building on our current system because you’re building wind farms that are idle more often than they’re productive,” he says.

“The more of them you build, the worse that gets. If you introduce a more sensible market, meaning zonal, then all that infrastructure should be more productive, and costs come down.”

Vince, however, disagrees: “Zonal pricing would be one of the most complicated reforms that we could make to our energy system.

“It would be lengthy and difficult to implement, with it being unlikely that it would be finished before 2030, more likely much later, which would create a huge deal of uncertainty for investors and market participants.”

The row over zonal pricing comes at a turbulent time for Britain’s energy system, with Miliband already pledging to remove gas-fired power stations from the system by 2030 – a hugely ambitious target.

Other forces are at work too. The long-term collapse of British industry saw demand for electricity plummet to 317 terawatt hours (TWh) in 2023, its lowest since the 1980s.

But, according to Milliband, the shift to heat pumps and electric vehicles will reverse that decline. By 2050, UK demand could reach 700TWh – more than double current levels.

Meeting that demand will mean more than tripling the UK’s generating capacity from its current 116 gigawatts (GW) to more than 400GW.

That increase equates to nearly 100 nuclear power stations the size of Hinkley Point C, currently under construction insomaset.

Some experts have warned the reorganisation needed for zonal pricing would delay decarbonisation and disrupt the expansion of the grid.

Jackson, however, believes it would actually help by forcing developers to build wind and solar closer to places where demand is highest. F closer to England’s power-hungry cities rather than in Scotland.

Despite this, Jackson is adamant that the pros outweigh the cons, rejecting Vince’s view that zonal pricing is an unnecessary distraction.

The UK has some of the highest electricity prices in the world, with severe impacts on people and businesses as the current electricity market design is failing consumers and is no longer fit for purpose.