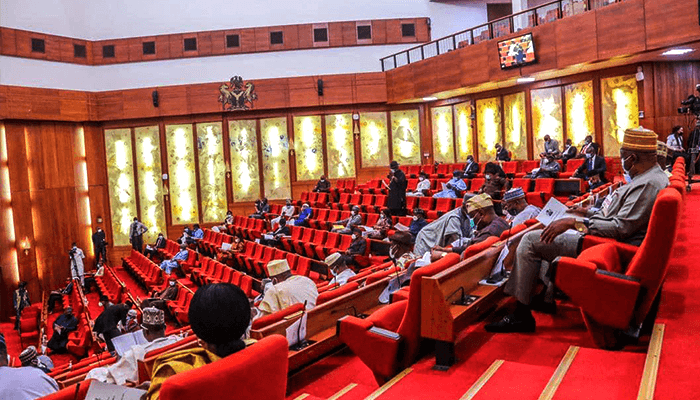

The Senate on Wednesday approved President Bola Tinubu’s request to obtain $2.847 billion in new foreign loans, including Nigeria’s debut $500 million Sovereign Sukuk, to finance part of the 2025 budget deficit and refinance maturing Eurobonds.

The approval followed the consideration of a report by the Senate Committee on Local and Foreign Debts, chaired by Senator Wamakko Magatarkada Aliyu (APC, Sokoto North), which reviewed the president’s proposal titled “New External Borrowing and Refinancing.”

According to the breakdown, $2.347 billion will be sourced from the international capital market to help bridge the 2025 budget deficit, while $500 million from the Sukuk issuance will fund critical infrastructure projects nationwide.

The move comes amid rising public concern over Nigeria’s mounting debt, which, according to the Debt Management Office (DMO), stood at over ₦97 trillion as of mid-2025.

While critics have warned of potential fiscal strain, government officials maintain that strategic borrowing is vital for sustaining growth, improving infrastructure, and maintaining investor confidence.

President Tinubu had, in a letter read on the Senate floor on 8 October 2025, sought legislative approval for the borrowing as part of the government’s plan to fund key national projects and manage debt obligations under the 2025 fiscal framework.

Presenting the committee’s report, Senator Wamakko said the borrowing plan was necessary to preserve economic stability, sustain ongoing projects, and safeguard Nigeria’s international credit standing.

Chairman of the Senate Committee on Finance, Senator Sani Musa (APC, Niger East), also backed the proposal, describing it as “critical for the smooth implementation of the 2025 Appropriation Bill.”

Similarly, Senator Adetokunbo Abiru (APC, Lagos East), who chairs the Banking, Insurance and Other Financial Institutions Committee, clarified that the borrowing would not increase the country’s debt burden but rather serve as a refinancing and compliance measure under the already approved budget.

Supporting the motion, Senator Adams Oshiomhole (APC, Edo North) argued that loans, when properly structured and channelled into productive sectors, could drive growth and job creation.

“There’s nothing wrong with borrowing if it is properly structured and used to address critical issues like unemployment and infrastructural decay,” Oshiomhole said.

The Senate’s endorsement marks a significant step in President Tinubu’s broader fiscal strategy to stabilise the economy and strengthen Nigeria’s financial position heading into the 2025 fiscal year.