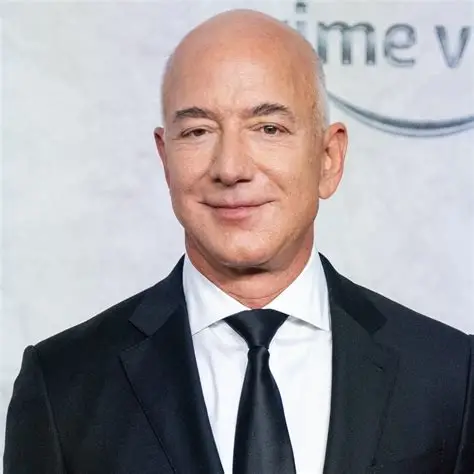

Jeff Bezos, the billionaire founder and chairman of Amazon, has completed a colossal round of stock sales worth nearly $5.7 billion (£4.4 billion), marking one of the largest insider share divestments of 2025.

The sale, carried out under a pre-arranged 10b5-1 trading plan, began shortly after Bezos wed his partner in a high-profile ceremony in Venice this June. His initial offload amounted to $737 million worth of Amazon shares.

According to a filing with the U.S. Securities and Exchange Commission (SEC) on Friday, Bezos sold the final tranche of approximately 4.2 million shares, valued at $954 million, across Wednesday and Thursday of this week.

In total, the tech mogul sold 25 million shares this year, capitalising on Amazon’s impressive stock market rally. Since its April low, the company’s share price has surged by 38%, driven largely by investor confidence in Amazon’s aggressive investments in artificial intelligence. The firm is set to report its latest earnings next week, with analysts keenly watching for signs of further AI advancements.

Despite the eye-watering sell-off, Bezos remains Amazon’s largest individual shareholder, holding roughly 884 million shares, equating to more than 8% of the company. His Amazon stake remains the cornerstone of his $252.3 billion (£196.3 billion) fortune, positioning him as the third-richest person in the world, according to the Bloomberg Billionaires Index.

Bezos sells 75m Amazon shares

Bezos is no stranger to such massive divestments. In 2024, he sold 75 million Amazon shares for $13.6 billion, using much of the proceeds to fund ventures such as his space exploration company, Blue Origin, and to support various philanthropic efforts.

In 2025 alone, Bezos has donated around $190 million worth of Amazon shares to non-profit organisations. Interestingly, over his more than two decades with Amazon, he has only purchased shares once, buying a single symbolic share for $114.77 in 2023.

This year’s $5.7 billion stock sale dwarfs similar moves by other corporate titans. Oracle CEO Safra Catz sold shares worth $2.5 billion in the first half of the year, while Dell Technologies founder Michael Dell offloaded $1.2 billion.

Bezos’s plan to sell up to 25 million shares, first disclosed in a May filing with the SEC is part of a long-term strategy. The structured trading plan allows the billionaire to gradually offload shares through to May 2026, offering him flexibility and legal protection from insider trading concerns.

While Amazon continues to expand its AI footprint, Bezos appears to be diversifying his financial empire, stepping further beyond the realm of e-commerce into space, science, and global philanthropy.