Prime Minister Sir Keir Starmer has refused to rule out tax increases this autumn, following a warning from a leading economic think tank that Britain faces a £50 billion hole in the public finances.

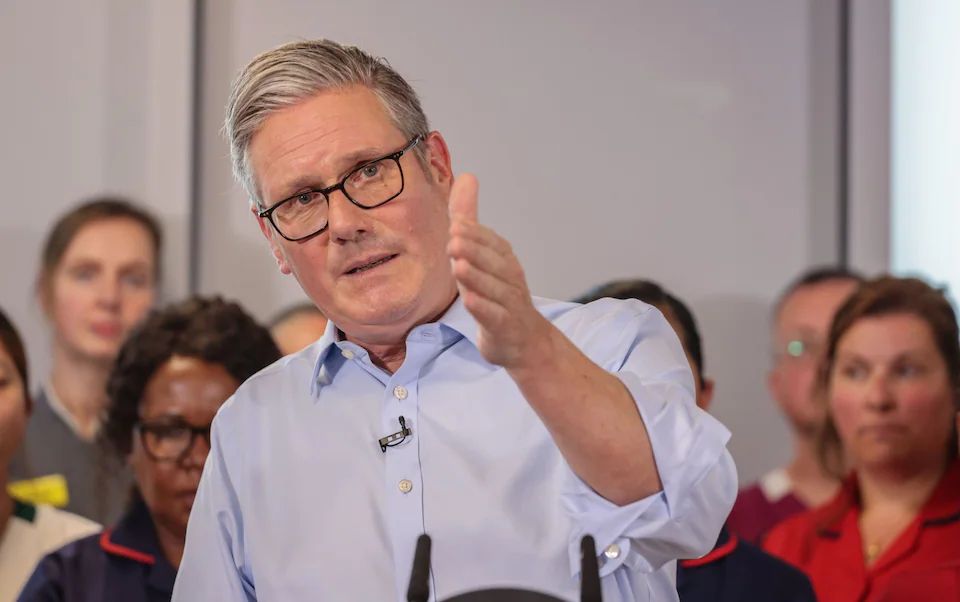

Speaking during a visit to Milton Keynes, Sir Keir declined to confirm whether the government would stick to previous pledges not to raise VAT, income tax, or corporation tax.

“In the autumn, we’ll get the full forecast and set out our Budget,” he said. “Our focus will be on living standards… we’ve stabilised the economy. Interest rates have now been cut four times, which helps mortgage holders directly.”

The warning came from the National Institute of Economic and Social Research (NIESR), which said that a combination of sluggish growth, a weakening labour market, and Labour’s welfare spending reversals had deepened the fiscal gap.

According to the institute, chancellor Rachel Reeves is on track to miss borrowing targets by £41.2bn, The government must either raise taxes or cut spending by £51.1bn to restore the £9.9bn fiscal headroom maintained since the last Budget.

The director of NIESR, David Aikman, said it would be increasingly difficult for Reeves to meet her fiscal rules and spending commitments without raising taxes on working people.

The think tank warned Reeves faces what it called an impossible trilemma, it is unlikely the government can meet all three of its core goals fiscal discipline, spending commitments, and avoiding tax rises.

Stephen Millard, NIESR’s deputy director, said, “Fiddling at the edges won’t cut it. These are the hard decisions the Chancellor must make to raise £50bn.”

The institute estimates that closing the gap could require tax hikes equivalent to a 5p increase in basic and higher rates of income tax. Alternatives such as freezing tax thresholds would disproportionately affect low-paid workers and pensioners. Raising VAT would hit poorer households, while higher corporation tax would hurt already-struggling businesses.

However, Labour is under pressure from both political opponents and internal factions. Critics say Reeves may have to break manifesto pledges not to raise taxes on working people.

Mel Stride, the shadow chancellor, accused Labour of “economic mismanagement,” blaming it for the widening black hole.

Richard Tice, deputy leader of Reform UK, said, “Starmer is living in cloud cuckoo land if he thinks the economy is stabilised. Labour’s policies have sent borrowing soaring while jobs and growth disappear.”

Meanwhile, Labour backbenchers and union allies are renewing calls for a wealth tax.

Richard Burgon, MP for Leeds East, proposed a 2% tax on assets over £10 million, estimating it could raise £24bn per year

Jon Richards, assistant general secretary of Unison, suggested taxing gambling firms and implementing an online sales tax on tech giants like Amazon

Supporters argue that such measures could avoid further cuts to vital services like disability benefits and winter fuel payments.

Separate HMRC data shows 2.6 million people will pay tax on savings this year up by over 120,000 from last year with the average saver owing £2,300, according to analysis by AJ Bell.

Despite insisting that her fiscal rules are iron clad, Chancellor Reeves is running out of options. With spending cuts politically fraught and tax rises unpopular, the government faces a challenging budget season ahead.