By Taiwo Oyedele

Some people have expressed the view that the proposed VAT rate increase as part of the Tax Reform Bills will fuel inflation and lead to more hardship for the people.

To address this issue, let’s examine the facts and answer some key questions:

Question 1

There are concerns that the VAT reform contained in the tax bills including the proposed increase in VAT rate will lead to inflation. Is this so?

Answer 1

No. The VAT reform, including the proposed increase in VAT rate, is part of a package involving several measures designed to reduce, NOT increase prices and therefore will not lead to inflation.

Question 2

But this position seems inconsistent with the views expressed by major actors in the current reforms when the previous government planned to increase the VAT rate in 2019. What has changed?

Answer 2

The major actors argued at the time that an increase in VAT rate will lead to inflation, which would reduce the purchasing power of Nigerians and increase economic hardship in the country.

However, unlike the 2019 VAT rate increase proposal which was not accompanied by measures to reduce costs, the current proposal is a package of reform, which is much broader than just a rate increase. The reform involves several measures to reduce production cost, reduce the incidence of VAT on most essential consumptions, and exempt more small businesses from charging VAT.

Question 3

Can you make it make sense?

Answer 3

Inflation occurs when there is a general increase in the prices of goods and services. An increase in VAT rate may lead to an increase in prices thereby causing inflation. However, the proposed VAT reform is not just about increase in rate, it contains several proposals to eliminate VAT or reduce rate which altogether is unlikely to cause inflation.

Specifically, the VAT reform measures include:

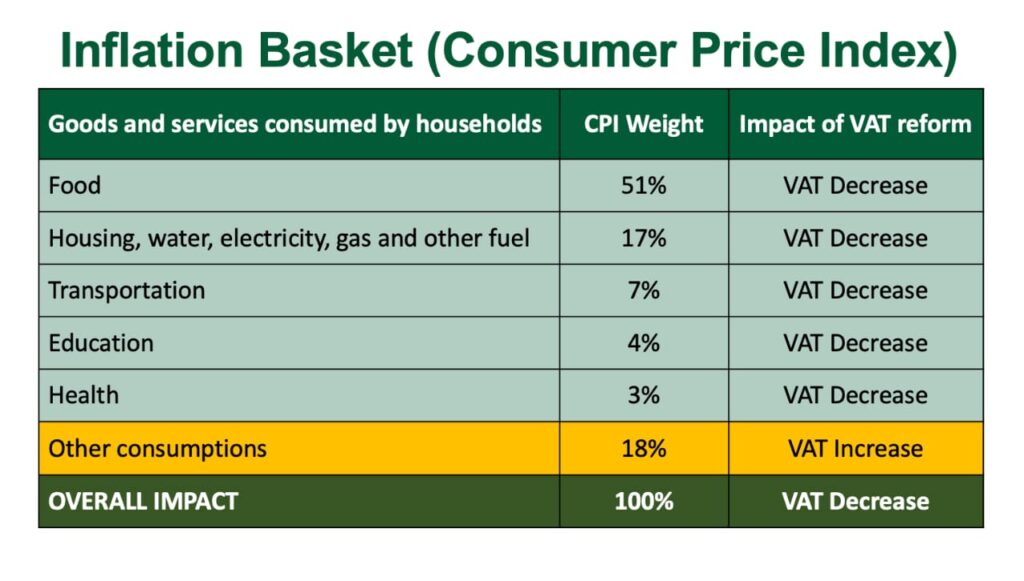

a) A reduction in the VAT rate to 0% and exemption for essential items accounting for 82% (about 4 out of 5 items) consumed by the masses including food, medical services and pharmaceutical products, tuition and other educational expenses, transportation, fuel products, and rent. (See the Consumer Price Index basket of goods and services).

b) Businesses will be granted tax credits for VAT paid on their assets and all expenses incurred to produce VATable goods and services. This means up to 7.5% reduction in the cost of production compared to the 2019 proposal where companies were not allowed to claim tax credit for their VAT costs which they then passed on to customers by way of higher prices. This proposed measure will eliminate the VAT cost currently borne by businesses and should therefore lead to lower prices. Going forward, this measure will ensure that businesses in Nigeria no longer bear VAT cost regardless of the rate.

c) An increase in the VAT exemption threshold for small businesses from N25m to N50m. This will remove the VAT burden on the margin of goods and services sold by such businesses who are usually patronised by the masses.

d) An increase in VAT rate on a limited number of goods and services constituting only 18% (about 1 in 5 items) of average consumption items in the inflation basket such as beverages, entertainment, cars, etc. These items are consumed more by the middle and high income earners than the poor.

Question 4

Okay, but won’t a business that pays a higher VAT rate for any item such as company vehicles, other assets, and raw materials, eventually pass it on to its customers by way of higher prices?

Answer 4

No. Remember that under these proposed reforms, businesses will be allowed to claim input credit for any VAT paid for the purpose of producing their VATable goods and services, so such businesses will become VAT cost neutral. This input VAT credit will also reduce the financing cost of assets and working capital for businesses, encourage formalisation for the informal sector given that a business needs to be registered with the FIRS to claim input VAT on its assets and other costs. In addition, the reform will improve Nigeria’s competitiveness and ability to attract investment within the African region and globally.

Question 5

Isn’t there a risk that businesses may not get the VAT credit on time or ever from the tax authority? What is the assurance that this will be effectively implemented?

Answer 5

There is no risk that a business will be denied a credit for its valid VAT claim. The VAT system has an inbuilt mechanism whereby a business is allowed to offset its input VAT by itself against its output VAT. The permission or approval of the tax authority is not required. In the event that a company does not have sufficient output VAT to offset its input VAT, a faster refund process is contained in the tax bills to grant such refunds within 30 days either in cash or with the option to utilise it for the payment of other taxes, at the discretion of the taxpayer.

Question 6

Alright, but why is it necessary to increase VAT rate on any item? Why not just reduce VAT and move on?

Answer 6

The various rate reductions and VAT credits will result in significant decline in government revenue from VAT which is a major source of government funding particularly for the states and local governments who share 85% of VAT (proposed to increase to 90%). Without an increase in the rate for some non-essential items to partly offset the reduction in revenue, many of the states and local governments may face financial difficulties. The limited rate increase also ensures that the VAT regime is progressive, whereby the masses bear little or no VAT burden while high income earners progressively bear higher incidence of VAT based on their consumption patterns and preferences. This promotes fairness and equity in the system by redistributing income, a major objective of the tax reforms.

Question 7

So, rather than generalising that the proposed VAT rate increase will lead to inflation, we need to check the details of the reforms before drawing such conclusions.

Answer 7

Absolutely. Unlike the previous proposal to increase VAT rate, the current VAT reform seeks to:

- Reduce VAT to 0% and exempt basic items constituting 82% of consumptions

- Grant input VAT credit on assets and other costs to businesses making them VAT neutral

- Increase the VAT exemption threshold for small businesses

Context matters. Any generalisation that the reforms will increase poverty is unfounded. Rather, these reforms will actually provide relief for the masses, reduce inflation, enhance purchasing power and reduce poverty.

Question 8

So, what happens if some businesses take advantage of the rate increase to raise their prices in order to make more profit despite a reduction in their costs?

Answer 8

This is where a basic understanding of the proposed VAT reform and its impacts is important to avoid creating an expectation of price increase which some businesses may exploit. We should all therefore equip ourselves with the basic knowledge and ask questions to discourage any such exploitation or price gouging.

Question 9

Okay. Can you summarise everything in a simpler manner?

Answer 9

Yes. Let’s do this using a VAT Reform Equation; assuming:

- Current prices of goods and services is (CP)

- Input VAT credit amounting up to 7.5% reduction in the cost of production is (IC)

- Reduction of VAT rate to 0% and exemption on 82% of all items consumed by the masses is (RR)

- VAT exemption for small businesses on all their goods and services mostly patronised by the masses is (SB)

- VAT increase on 18% of consumptions is (RI)

Therefore, CP – IC – RR – SB + RI = Lower Prices

Question 10

Anything else we should know about the reforms?

Answer 10

Yes, a lot. Please visit our website fiscalreforms.ng and social media accounts for more information including copies of the tax reform bills.