The Senate has approved President Bola Ahmed Tinubu’s request to raise ₦1.15 trillion from the domestic debt market to finance the unfunded portion of the 2025 budget deficit.

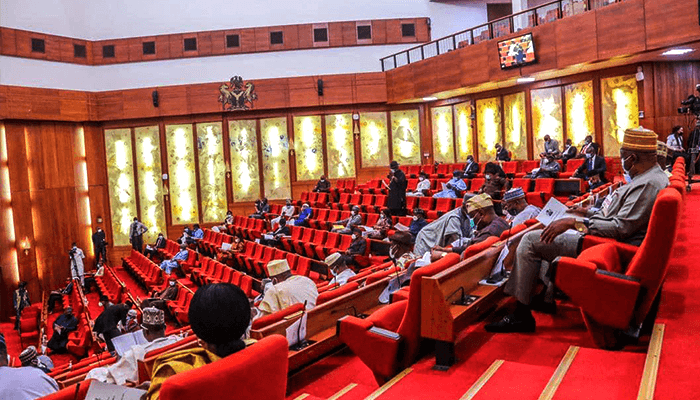

The approval came on Wednesday following the adoption of a report presented by the Senate Committee on Local and Foreign Debt during plenary.

According to the committee’s report, the 2025 Appropriation Act provides for a total expenditure of ₦59.99 trillion, reflecting an increase of ₦5.25 trillion over the ₦54.74 trillion initially proposed by the Executive. This expansion created a total budget deficit of ₦14.10 trillion, out of which ₦12.95 trillion had already been approved for borrowing, leaving an unfunded balance of approximately ₦1.15 trillion (₦1,147,462,863,321).

President Tinubu’s formal request, submitted to the Senate on 4 November, sought legislative approval to borrow the additional funds domestically in order to close the gap and ensure full implementation of key government programmes and projects under the 2025 fiscal framework.

“This borrowing will bridge the funding shortfall and guarantee the successful execution of the 2025 fiscal plan,” Tinubu stated in his letter to the National Assembly.

READ ALSO: Tinubu seeks Senate approval for $2.3bn external loan, $500m sovereign Sukuk

The Senate’s endorsement effectively authorises the Federal Government to approach the domestic capital market for the facility, which will be used to sustain critical capital and recurrent expenditures.

In a related development, a motion sponsored by Senator Abdul Ningi was adopted, mandating the Senate Committee on Appropriations to strengthen oversight on the utilisation of the borrowed funds. The committee was specifically directed to ensure that all proceeds are deployed strictly for their intended purposes and in accordance with the provisions of the Appropriation Act.

The Senate reaffirmed its commitment to transparency in public finance management, emphasising that effective monitoring of borrowings is crucial to maintaining fiscal discipline and public trust.