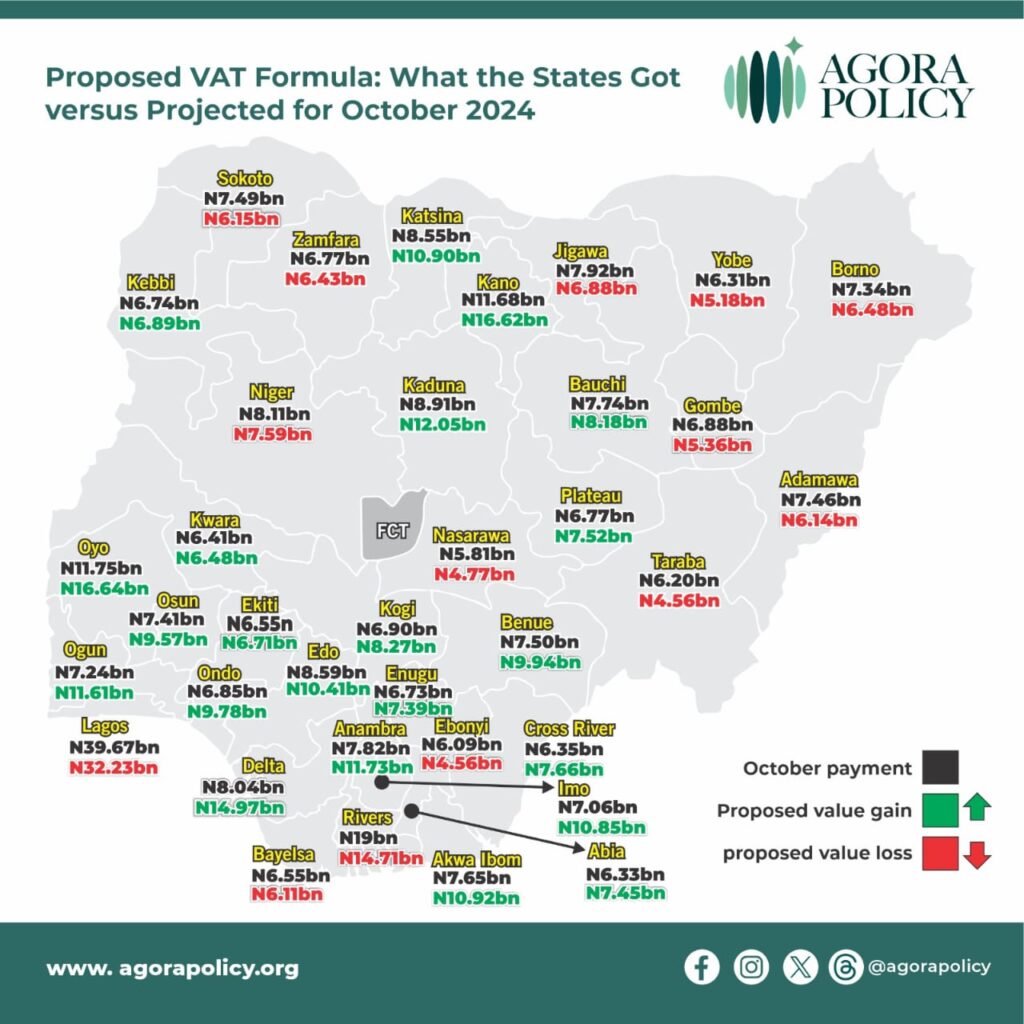

Based on actual data for October 2024, our simulation indicates that:

- States’ share of VAT increases to N342.27b from N311.16b.

- Despite the overall increase, 14 states will be worse off while 22 states will be better off. 👇

- 🚨Likely Gainers and Losers from Proposed VAT Formula…

To check figures shared on TV last night on the possible impact of the proposed VAT formula on states, we did a quick simulation.

We ran what states got for October 2024 with what they would have received under the proposed formula.

We assumed the following:

- States’ s share of VAT increases from 50% to 55%.

- Horizontally, the sharing formula changes to: 60% for derivation (from 20%); 20% for population (from 30%); 20% for equality of states (from 50%).

- We used:

- FAAC population index to calculate shares to states on population;

- NBS’s 2019 consumption expenditure report as a proxy for consumption across the states.

- An average of NE states as an estimate for Borno State, which was not included in the NBS report.

- Losers: Lagos State would have lost the highest amount of N7.44b while Zamfara State would have lost the least of N344.23m.

Gainers: Delta would have gained the highest of N6.93b while Kwara would have gained the least of N74.26m.

The picture looks slightly different in terms of percentages:

- Gains would have ranged from 86.17% for Delta to 1.16% for Kwara.

- Losses would have ranged from 26.45% for Taraba to 5.08% for Zamfara.

- According to our simulation, this is zonal distribution of the 14 states that would have been worse off:

5 in the NE

2 in the NC

3 in the NW

1 in the SE

2 in the SS

1 in the SW.