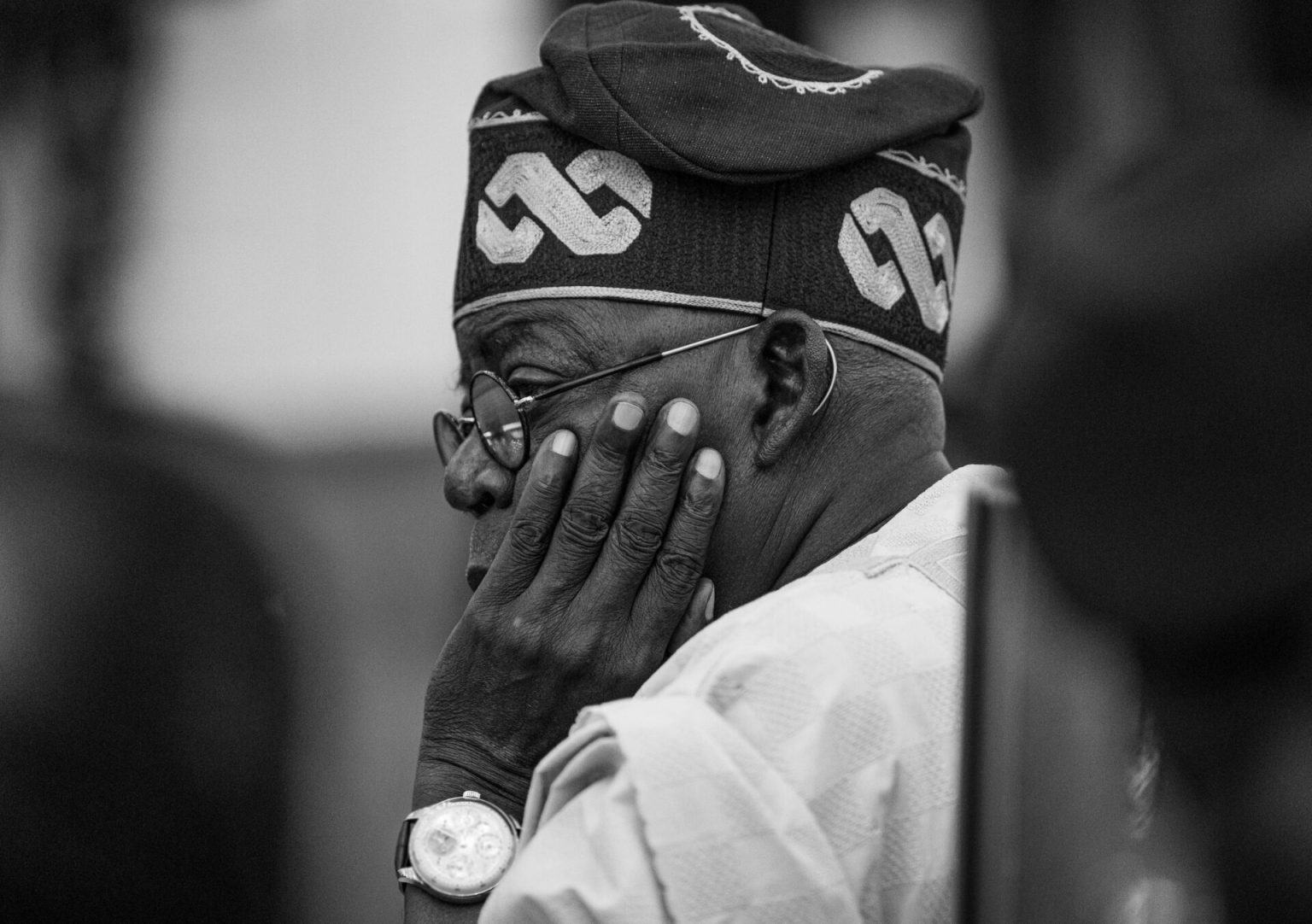

By Sakariyah Ridwanullah Today, Nigeria feels like a nation walking through fire with its eyes fixed on a distant promise of light. Markets are noisier, wallets are thinner, and every journey by bus or commercial transport feels like a negotiation between necessity and affordability. Conversations in homes, offices, and campuses now orbit the same themes: the rising cost of living, structural reforms, and the leadership of President Bola Ahmed Tinubu. In interviews conducted by New Daily Prime across Lagos, Ogun, Oyo, Kwara, and Sokoto states, ordinary Nigerians spoke with unusual candour about pain, patience, hope, and distrust. The administration’s diagnosis…

Author: New Daily Prime

The All Progressives Congress (APC) in Ikwerre Local Government Area of Rivers State has passed a resounding vote of confidence in President Bola Tinubu, hailing his leadership as a beacon for Nigeria’s future. The endorsement, made at a party meeting on Monday, comes amid the state’s ongoing impeachment crisis, underscoring loyalty to the national leader despite local tensions. Party members commended Tinubu’s “Renewed Hope” agenda, crediting it with economic reforms, infrastructure boosts, and security gains. “He’s delivering for Rivers and Nigeria,” a local chairman said, urging unity behind the president for 2027. Read related news from New Daily Prime: APC…

Weekly Love Story Column by Olayinka Owolabi-Ajayi Attraction is instant. It is the spark that catches your attention, the chemistry that makes conversation flow easily, and the excitement that reminds you what is possible. It feels natural, effortless, and powerful. While it can begin a love story, it rarely sustains it. Attraction happens in the moment.Alignment is built over time. You can be deeply drawn to someone’s looks, energy, or personality, yet still discover that your values, goals, and vision for the future do not match. Attraction is what you feel , alignment is what you build together through understanding,…

By Jeremiah Aminu Self-censorship has, in recent years, become one of the topical issues dominating critical discourses revolving around press freedom within the Nigerian journalistic space. While some have foregrounded the merits that accompany its utilisation, many have also underscored its dismerits, most especially the risks that it poses to the journalistic integrity and credibility of the Nigerian press. However, before proceeding onward, it is essential to, first of all, understand the meaning of the term, self-censorship, before discussing its operations within Nigerian journalism. Self-censorship, as defined by Merriam-Webster Dictionary, refers to “the act or action of refraining from expressing…

By Jeremiah Aminu Nigerian roads have, in recent years, become breeding grounds upon which accident casualties thrive. Recent statistical reports from the National Bureau of Statistics (NBS) and the Federal Road Safety Corps (FRSC) serve as testaments to this gruesome fact, as they reveal the alarming rate in which accident casualties (both ghastly and fatal) occur on Nigerian roads. On the one hand, the NBS, in a 2023 Social Statistics report, recorded over 18,386 cases of road accidents in a span of three years, with 5472 incidents in 2020, 6336 in 2021, and 6578 in 2022. Much more recently in…

By Jeremiah Aminu A raging wave of nationwide outrage has descended upon the shores of the Nigerian social media space regarding PayPal’s return into the Nigerian fintech terrain. This is tied to the promotion of the corporation’s initiative, PayPal World, whose function is etched around aiding cross-border payments in Nigeria without the need of opening a traditional PayPal account for transactional purposes. While this announcement appears as an answered prayer to years of clamours by some Nigerians, to many Nigerians, it is a reminder of years of lost opportunities, heartaches, economic segregation, and heavy financial losses. Many Nigerians, most especially…

The naira’s performance against the euro on Saturday, 17 January, 2026 reflected a cautious equilibrium across Nigeria’s foreign exchange markets, with contrasting signals from the official and parallel segments. According to data published by the NGNToday platform, the official exchange rate for the euro closed at N1,649, unchanged from N1,649 recorded on Friday, 16 January. Although the figure remained flat, analysts describe the movement as a sign of underlying weakness, as the naira failed to post any recovery amid ongoing demand pressures for the European currency. At the black market, the euro also traded steadily at N1,705, maintaining the same…

The Nigerian naira recorded a broad-based decline against the British pound on Saturday, 17 January, underscoring renewed pressure across both regulated and unregulated foreign exchange segments. Figures published by the NGNToday platform indicate that the official exchange rate for the pound sterling fell to N1,893, down from N1,913 on Friday, 16 January. The movement reflects a depreciation of the naira at the formal window, interrupting the relative stability seen earlier in the week. The trend was mirrored more sharply in the black market, where the pound exchanged at N1,950, weakening further from N1,995 recorded the previous day. This shift highlights…

The naira delivered a mixed performance against the United States dollar on Saturday, 17 January, reflecting the persistent divergence between Nigeria’s official and parallel foreign exchange markets. Data obtained from the NGNToday platform show that the naira appreciated at the official market to N1,422 per dollar, improving slightly from N1,419 recorded on Friday, 16 January. This marginal gain signals continued efforts by monetary authorities to stabilise the formal foreign exchange window through tighter controls and managed liquidity. However, the picture was less positive at the black market, where the naira depreciated to N1,470 per dollar, compared with N1,487 the previous…

The leadership of the All Progressives Congress (APC) UK Manchester Caucus is pleased to receive the news that Abba Abubakar, son of former Vice President Atiku Abubakar, has decided to support the re‑election of President Bola Ahmed Tinubu in 2027. This decision shows that more Nigerians are accepting President Tinubu’s leadership and his plan to rebuild Nigeria through the Renewed Hope Agenda. It also confirms that the President’s policies and reforms are bringing people together across different political parties in the interest of progress, stability, and economic growth. Read related news from New Daily Prime: Atiku reacts as son dumps PDP for APC As an organisation that…