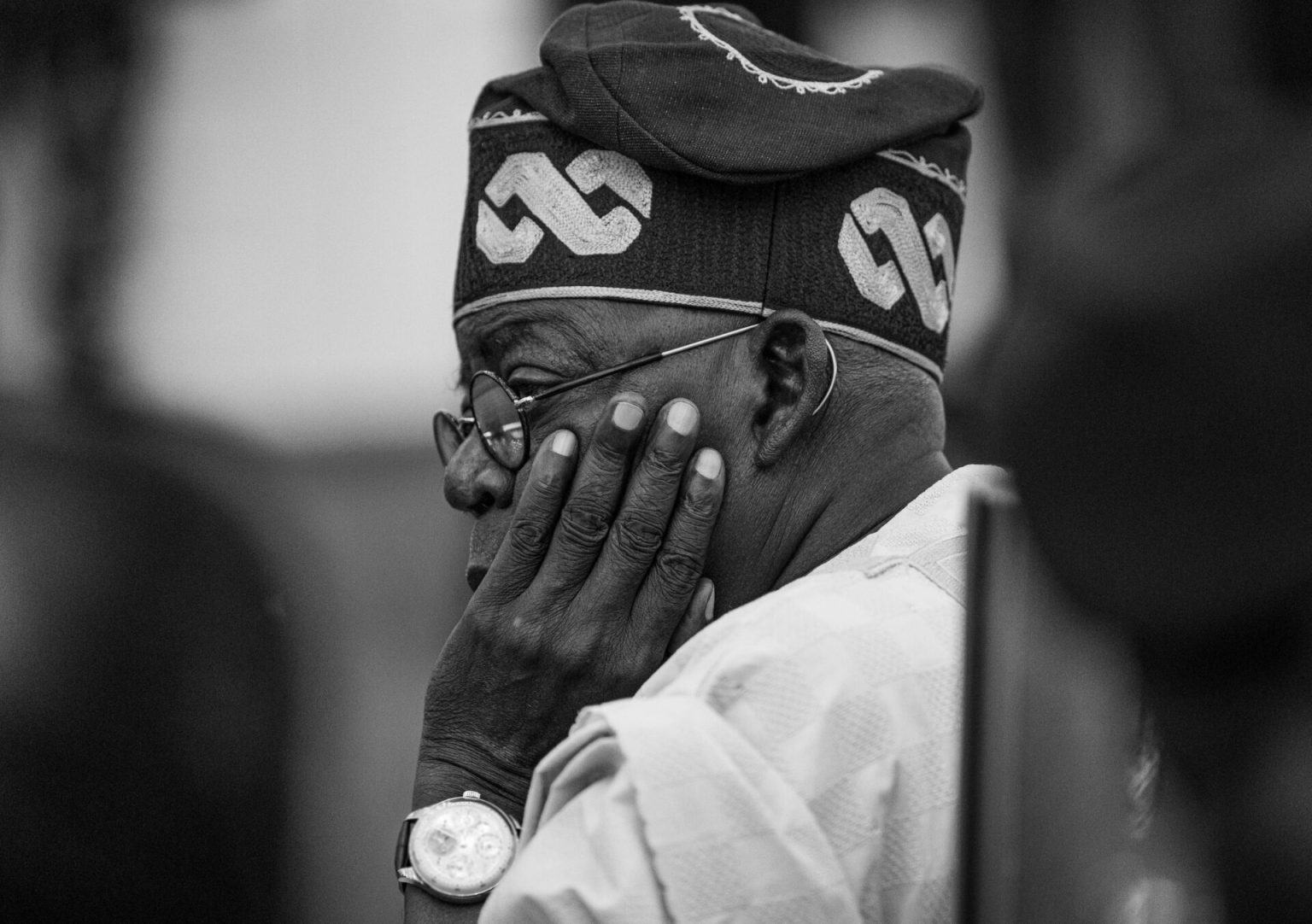

President Bola Tinubu has reaffirmed that the implementation of Nigeria’s tax reform laws will begin as scheduled on January 1, 2026, dismissing calls for a delay amid public controversy.

In a statement issued on Tuesday, Tinubu described the reforms as a historic opportunity to lay a strong, equitable and competitive fiscal framework for the country, stressing that the new laws are not intended to increase the tax burden on citizens.

“The new tax laws, including those that took effect on June 26, 2025, and the remaining acts scheduled to commence on January 1, 2026, will continue as planned,” Tinubu said.

“These reforms are a once-in-a-generation opportunity to build a fair, competitive, and robust fiscal foundation for our country.

“The tax laws are not designed to raise taxes, but rather to support a structural reset, drive harmonisation, and protect dignity while strengthening the social contract.

“I urge all stakeholders to support the implementation phase, which is now firmly in the delivery stage.”

While acknowledging the controversy over alleged discrepancies between the versions of the tax laws passed by the National Assembly and those later gazetted, Tinubu said no issue serious enough had been established to justify halting the reform process.

“Our administration is aware of the public discourse surrounding alleged changes to some provisions of the recently enacted tax laws,” Tinubu said.

“No substantial issue has been established that warrants a disruption of the reform process. Absolute trust is built over time through making the right decisions, not through premature, reactive measures.

“I emphasise our administration’s unwavering commitment to due process and the integrity of enacted laws. The Presidency pledges to work with the National Assembly to ensure the swift resolution of any issue identified.

“I assure all Nigerians that the Federal Government will continue to act in the overriding public interest to ensure a tax system that supports prosperity and shared responsibility.”

The debate was triggered on December 17 when Abdussamad Dasuki, a member of the House of Representatives, alleged that differences existed between the tax reform bills approved by lawmakers and the versions made public through gazetting. The claim sparked widespread reactions, with some Nigerians calling for a suspension of the reforms.

In response, the leadership of both chambers of the National Assembly, on December 26, directed the Clerk to the National Assembly, Kamoru Ogunlana, to collaborate with relevant executive agencies to re-gazette the tax laws in order to address the concerns raised.