Nigeria may soon see a major shift in how money moves across the country, as the Nigeria Interbank Settlement System (NIBSS) prepares to scrap transfer charges on its instant payment platform.

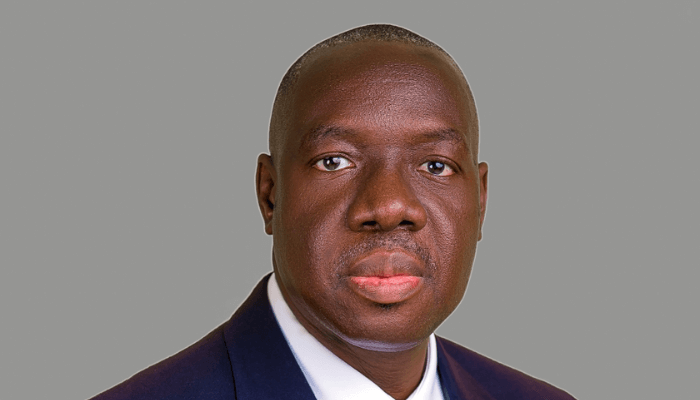

The move, according to its managing director and chief executive officer, Premier Oiwoh, is aimed at making digital payments cheaper, faster, and more appealing than cash.

Speaking at the Globus Bank Fintech Summit 2025 in Lagos, where he delivered a keynote on “From Cashless to Smart Economies: Shaping the Next Frontier of Financial Innovation,” Oiwoh announced that a new subscription-based model would replace the current transfer fees.

The change, he explained, would take effect next year.

“Our biggest competition is not fintechs or banks; it is cash on the streets,” Oiwoh told participants. “Eliminating fees will make digital payments more attractive to everyday Nigerians.”

Beyond reducing costs, he argued, the country must build a payment system that is secure, interoperable, and resilient against fraud and cyber threats.

While countries like India and China had national strategies to pull millions into the financial system, Nigeria, he noted, still operates largely in silos.

He called for a government-led roadmap to deepen financial inclusion, warning that simply opening bank accounts without ensuring access to real economic opportunities does little to solve the problem.

Oiwoh also praised the Central Bank of Nigeria for its regulatory drive, particularly the adoption of ISO 20022 messaging standards, which bring Nigeria’s payment system in line with international best practices.

Turning to AFRIGO, the country’s homegrown card scheme, he revealed that it had already processed more than N70 billion worth of transactions in 2025, with over one million cards in circulation. He described it as the only card in the world that allows instant credit at point-of-sale, a feature that has encouraged merchants to embrace it.

Read Also: “We’ll continue to fix economy” Tinubu assures citizens

Another milestone, Oiwoh announced, is the upcoming multipurpose national identity card from the National Identity Management Commission (NIMC).

The card will come embedded with Afrigo’s payment functionality, ensuring that millions of Nigerians can access financial services through their national ID.

On the risks that come with digital payments, he warned that insider collusion remains one of the greatest dangers. He pointed to the NIBSS Hawk monitoring platform, which has already stopped multiple fraud attempts, as evidence of the industry’s growing defences.

“We must never put profitability above compliance,” he cautioned. “One regulatory sanction or a single fraud incident can wipe out years of profits.”

For Oiwoh, collaboration among banks, fintechs, and service providers is key. The real contest, he insists, is not between industry players, but against the stubborn dominance of cash.

With innovations ranging from QR payments to NFC and biometrics, supported by government initiatives such as geo-tagging and fintech demo days, he believes Nigeria is edging closer to becoming a truly smart economy.

“Payments,” he concluded, “are not the destination. but the foundation for building a vibrant digital economy where innovation, inclusion, and trust drive prosperity.”