The global economy is slowing more than previously expected, with the Trump administration’s ongoing trade war increasingly affecting U.S. growth, the Organisation for Economic Co-operation and Development (OECD) warned on Tuesday.

In its latest Economic Outlook, the Paris-based organisation revised its global growth projections downward, citing rising protectionism and persistent trade tensions.

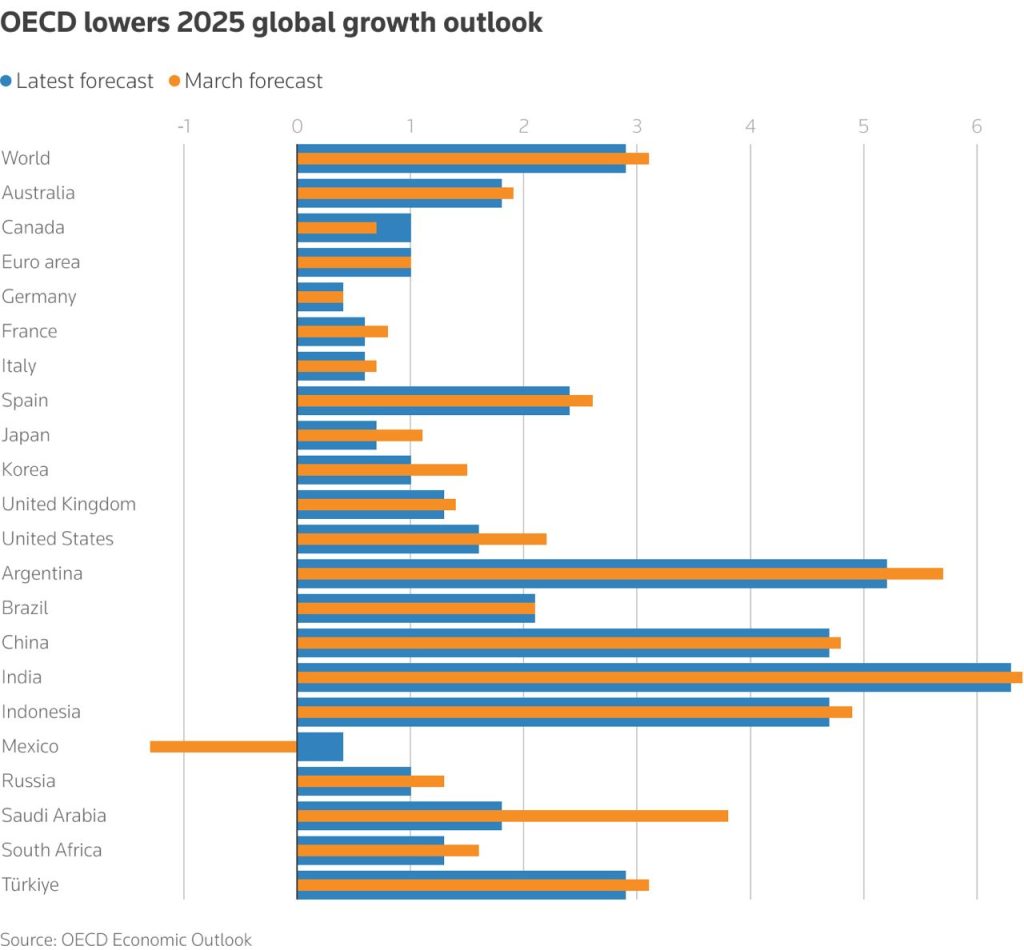

Global economic growth is now projected to decline from 3.3 per cent in 2024 to 2.9 per cent in both 2025 and 2026. This marks a downgrade from the OECD’s March forecast, which anticipated growth of 3.1 per cent this year and 3.0 per cent next year.

The OECD cautioned that the outlook could deteriorate further if trade barriers continue to rise, triggering higher inflation, disrupting global supply chains, and unsettling financial markets. The impact of escalating U.S. tariffs since President Donald Trump took office has already caused market volatility and growing uncertainty, leading to a rollback of some earlier tariff decisions.

A temporary truce between the U.S. and China last month included scaled-back tariffs, and Trump delayed a planned 50 per cent tariff on European Union goods until July 9. However, the OECD’s projections assume that tariffs in place as of mid-May will remain throughout 2025 and 2026.

As a result, the OECD now expects the U.S. economy to grow just 1.6 per cent in 2025 and 1.5 per cent in 2026. These figures represent significant downward revisions from previous estimates of 2.2 per cent and 1.6 per cent, respectively.

While tariffs may encourage domestic manufacturing, the OECD noted they also lead to higher import costs, which erode consumer purchasing power and dampen business investment due to increased policy uncertainty.

Additionally, the report warned that any revenue gains from tariffs will only partially compensate for revenue losses from recent U.S. tax cuts and slower economic growth. The extension of the 2017 Tax Cuts and Jobs Act, along with additional tax reductions, is expected to push the U.S. budget deficit to 8 per cent of GDP by 2026, one of the largest peacetime deficits among developed nations.

With inflationary pressures fueled by tariffs, the Federal Reserve is expected to keep interest rates steady through 2025, before gradually reducing the benchmark rate to between 3.25% and 3.5% by the end of 2026.

In China, the OECD said that while the economy will feel the effects of U.S. tariffs, these will be partly mitigated by government subsidies under a consumer goods trade-in program and expanded welfare support. China’s economy is forecast to grow 4.7 per cent this year and 4.3 per cent in 2026, only slightly revised from previous estimates.

The euro area’s outlook remains unchanged from March, with growth forecast at 1.0 per cent in 2025 and 1.2 per cent in 2026, supported by resilient labour markets, expected interest rate cuts, and increased public spending,g particularly in Germany.

The United Kingdom’s forecast was modestly improved for this year, with growth now expected at 1.3 per cent, though its 2026 projection was trimmed to 1.0 per cent, down from 1.2 per cent in earlier estimates.