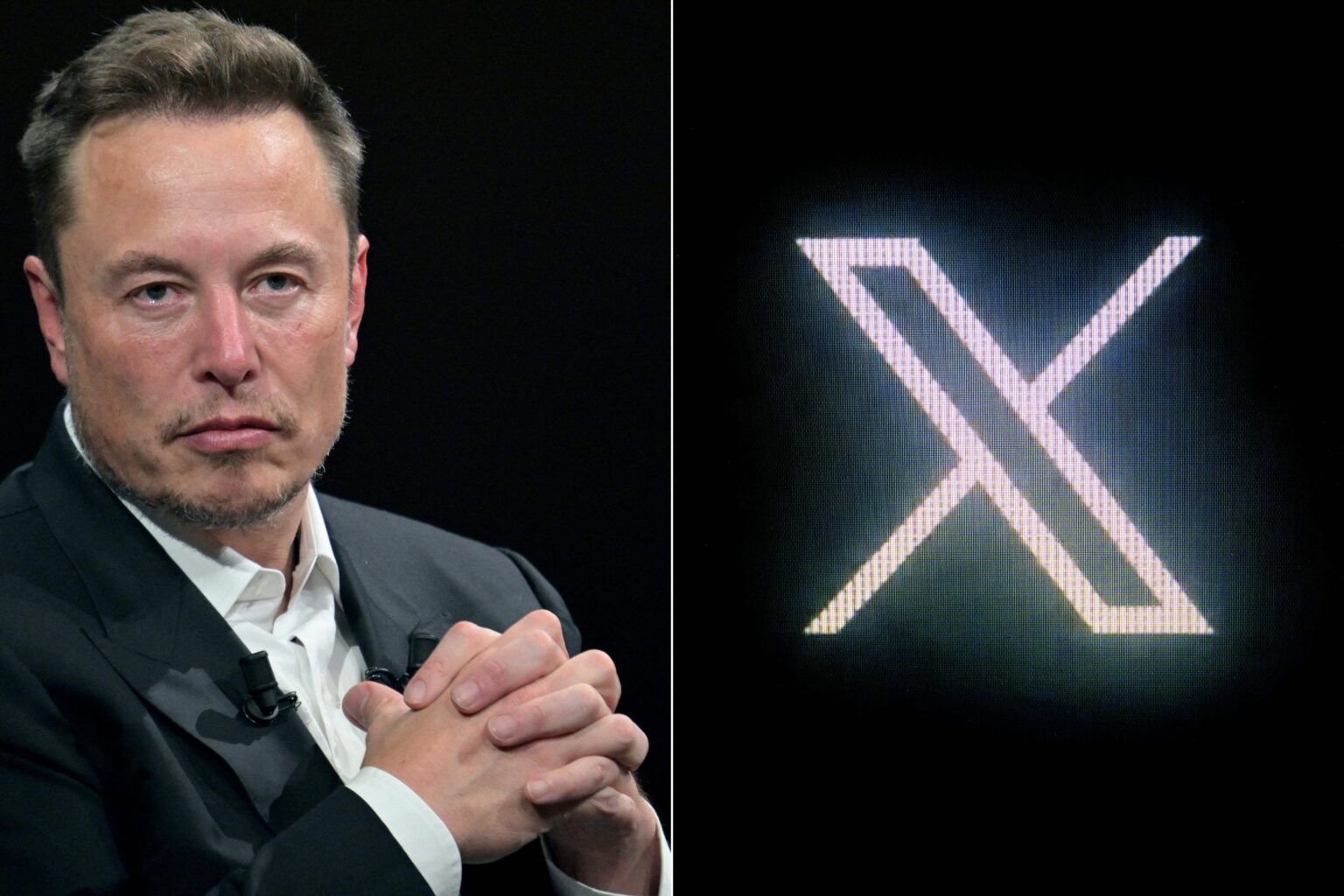

The U.S. Securities and Exchange Commission (SEC) has filed a lawsuit against Elon Musk, claiming that his 2022 purchase of Twitter shares violated securities laws.

The SEC’s court filing, published Tuesday, asserts that Musk failed to submit a required beneficial ownership report after acquiring more than five per cent of Twitter’s common stock in March 2022.

The SEC argues that Musk’s failure to file the report on time allowed him to continue buying shares at “artificially low prices,” enabling him to underpay by at least $150 million for shares purchased after the report was due.

The 53-year-old attorney, Alex Spiro, dismissed the SEC’s lawsuit as a sham and part of a multi-year campaign of harassment against the billionaire.

READ ALSO: 10 Elon Musk quotes inspiring success greatly

“Today’s action is an admission by the SEC that they cannot bring an actual case,” Spiro said in a statement.

Musk’s tenure at Twitter, now rebranded as X, has been plagued by controversy, sparking numerous legal challenges from investors, former employees, and businesses that held contracts with the platform.

Shareholders have also filed a lawsuit against Musk, accusing him of failing to disclose his five per cent ownership in the company within the SEC’s prescribed timeline.